Message from CEO

Steve Wong

FMBA (Hon), C.Mgr, D.Mgr, PhD (Hon)

CEO, Fukutomi

Executive President, China Scrap Plastics Association

The years 2022-2023 has been a challenging one for the industry as a whole. With the COVID-19 situation gradually improving, there are still factors such as inflation, potential increases in interest rates, and the intricate dynamics of country politics causing plastic material prices to spiral down. These negative elements have inevitably led to a significant slowdown in the recycling market. Petrochemical manufacturers’ continued expansion plans to increase production capacities have further exacerbated the overcapacity issue and price impacts, in addition to the global economic slowdown.

Furthermore, China’s decision to open up the petrochemicals industry to the private sector has led to a doubling of virgin pellet output with the latest technological advances. In China, examples include polypropylene production capacity approaching 39 million tons per annum, representing an increase of 30%. Other examples such as ABS and polyester, have also seen significant increases in production capacity. This has created a vicious circle situation for virgin pellets along the value chain of the plastic recycling industry and the recycled plastic market. Brand owners and plastic product manufacturers tend to use more new materials for cost reasons, which has had a ripple effect on the recycled materials market.

The Basel Convention amendment, which restricts the movement of plastic waste to non-OECD countries, has compelled conventional exporting countries to increase recycling at the source for plastic waste. This has resulted in a global shift in the supply chain for plastics and devastating impacts on the recycling industries in Southeast Asia.

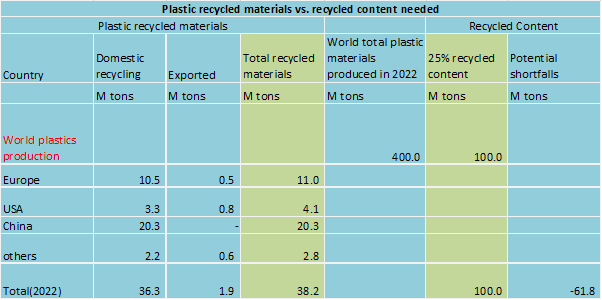

While we are entering the era of reuse and recycled content for products, with an initial target of 25 percent, the global use of plastics amounts to 400 million tons annually, and it is estimated that 100 million tons of plastics should be recycled. Unfortunately, global recycling has only reached 40 million tons currently, which means there is still a long way to go, and a lot of recyclables end up in landfills. On the other hand, the potential business available to the recycling industry in the future is enormous.

Looking ahead, I anticipate that market changes will eliminate some market players in the short term. Many countries have to bear the environmental cost of low-value plastic waste due to the lack of recycling interest in these items, leading to landfilling as the only outlet. Therefore, a global policy mandating the use of recycled materials becomes inevitable. While the global plastics production had reached a 400 million tons level by 2022, the global quantity of recycled plastics only stood at a 38.2 million tons level versus a 100 million tons or 25 percent recycled content target. With the shortfall of 61.8 million tons to reach a 25 percent target, it leaves the recycling industry a huge business potential (see Schedule below). Fukutomi pledges to promote the use of recycled materials and stay true to its commitment to alleviate global resource depletion.

Aiming to play a pivotal role in the supply chain of the recycling industry, Fukutomi will continue to expand its business networks globally, apart from strengthening relationships with existing business partners. The company thanks its supporters for their continued confidence and looks forward to working together to create a better future.

Recognizing the tough market environment and the unstable use of recycled materials by product manufacturers currently, unless mandated to do so, I will advocate for policy pushes and voice support for the recycling industry through my role as an Observer of UNEP and as a speaker at different events and conferences.

Schedule (2022):

Global Production of Plastics (全球塑料生產):

Plastic recycled materials vs recycled content needed:

塑料再生材料與所需的再生成分: